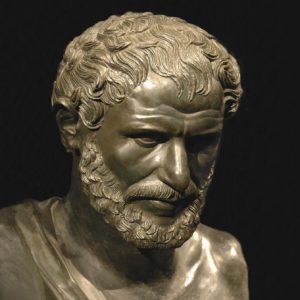

Heraclitus

“Change is the only constant in life” according to Heraclitus. Never met the guy but he definitely hit the nail on the head. And then Robert Burns doubled down on the thought with “The best-laid plans of mice and men often go awry”. Term or permanent life insurance? What length of term or what kind of permanent? How about options in your life insurance duration?

We all do our best to prepare for the future, and with life insurance, prepare for our family’s or business’s future. The challenge and the dilemma is that we are often going where no mere mortal should when we start trying to guess what will really be needed 20 or 30…or 50 or 60 years down the road. I’m going to do my best to lay out some methods or ideas for how we can give you options in your life insurance duration and see the difference the best-laid plans might make.

Success story. Finding the perfect life insurance option.

I have a client in his mid 50’s who took out a 20 year term life policy a few years ago. His assumption was that most of his needs for life insurance would have resolved themselves by the end of the 20 years, kids well established, house paid off, retired, etc. He called a few days ago and has decided that having his life insurance ending in his mid 70’s may not be the best idea. I told him the only options at his age would be a longer term product or something permanent. He saw a longer term as just kicking the can down the road, but also noted that if he went with a no lapse guarantee UL (the only permanent product that would fit in his budget) and reached a point where he no longer needed the insurance he would have wasted a lot more in premium dollars. The answer to his permanent quandary lies in products that American General and Lincoln National offer. It’s very competitive in price with the best priced GUL’s where he would lose all of his money if he outlived the need or couldn’t afford it anymore, but these two companies have a gold nugget in their policy. With AIG in the 25th year you can get a full return of all the premiums paid in. Lincoln gives you two options to bail out with a full refund at years 20 and 25. That would be in his early 80’s, a time when future needs will be crystal clear(er) than they are right now. Hmm!

Which brings me to another method of taking some pressure off of a one size fits all your future needs box with some options in your life insurance duration. If a person isn’t real clear about all of their life insurance needs going away by the end of, say, 20 years, we can take a look at layering term insurance. When you have kids that will be grown and gone in 5-10 years, a mortgage that will last 18 more years (if the refi folks will leave you alone), and your first potential retirement date in 25 years and all the needs total $1 million, think about this. Instead of taking out $1 million for 25 or 30 years, why not carry three life insurance policies, $500,000 for 10 years (kids grown and gone), $250,000 for 20 years (mortgage paid off) and $250,000 for 30 years (retirement in the bag). So, for the first 10 years when the needs are the greatest you have $1 million, then $500,000 for another 10 years, then $250,000 to 25 or 30 years. You can even stretch that out longer now that life insurance companies are starting to offer 35 and 40 year terms. It’s less expensive than buying one long policy and more closely mirrors your actual needs.

Back to my client above and the answer to his permanent (maybe) question. What if, instead of the $1 million with a return of premium option, he layers it into two policies. Each policy will have a full refund feature in year 20 or 25, but by layering his permanent insurance he has the option of downsizing in his early 80’s by leaving one in force and walking away (with a full refund) from the other. Or he could end both policies and get the full refund and put that in the bank and be self insured.

Bottom line. If you would like to look at options that might make more sense than trying to fit all of your life insurance needs in to a one size fits all solution, call or email me directly. My name is Ed Hinerman. Let’s talk.

My 20 years of experience give me the knowledge and leverage to find reasonably-priced life insurance for people who have been declined or are paying more than they need to.

My 20 years of experience give me the knowledge and leverage to find reasonably-priced life insurance for people who have been declined or are paying more than they need to.

Recent Comments